change in net working capital as a percentage of change in sales

Net working capital which is also known as working capital is defined as a companys current assets minus itscurrent liabilities. Percentage change is an important tool to give clarity of thought about the direction.

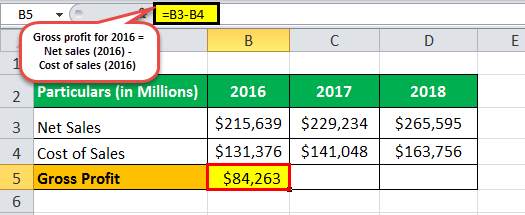

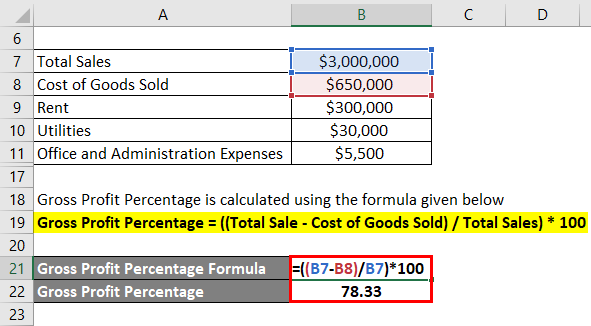

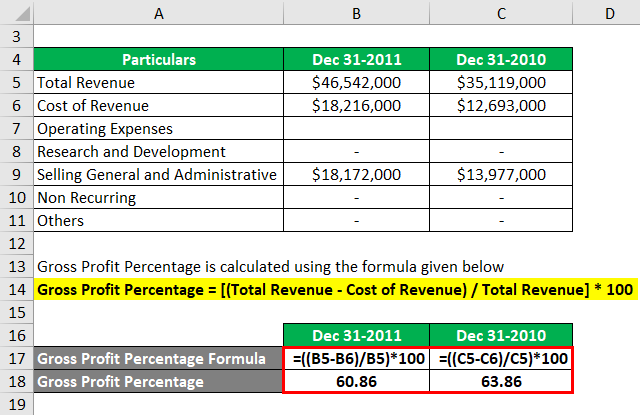

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Companies may over stock or under stock because of expectations of shortage of raw materials.

. The percentage of sales method is the simplest and easiest way of finding future working capital. If a business requires a lot of current assets to generate sales and those assets are funded by cash then the net working capital as. And it helps determine this amount based on the total revenue or sales from an operation.

For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20. If a transaction increases current assets and. When sales increase but working capital falls the company may have difficulty sustaining operations and purchasing inventory to fulfill new orders and it may also experience other financial problems.

The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales. Click the answer you think is right Change in profitability Percentage increase in sales Market value of firm Level of net working capital Which one of these terms is the price at which one share of common stock can currently be sold. Changes in working capital are reflected in a firms cash flow statement.

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. How do you calculate percentage change in working capital.

For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this. Now changes in net working capital are 3000 10000 Less 7000. For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042.

Change in Working capital does mean actual change in value year over year ie. First each component of working capital as a percentage of sales is calculated. Now lets break it down and identify the values of different variables in the problem.

So the Net Working Capital of Jack and Co is 80000. In this case the change is positive or the current working capital is more than the last year. To calculate net sales subtract returns 400 from gross sales 25400.

It means Company A would have to find ways to fund this increase. Change in Net Working Capital 12000 7000. Working capital as a percent of sales is calculated by dividing working capital by sales.

Hence there is obviously an assumption that working capital and sales have been accurately stated. Examples of Changes in Working Capital If a companys owners invest additional cash in the company the cash will increase the companys current assets with no increase in current liabilities. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent.

Net Working Capital Formula Current Assets Current Liabilities. Either change is moving in a favorable direction or do we need to change our strategies to bring changes as per our goals and objectives. Its primary benefit is measuring the amount of working capital needed or to specify the size of working capital requirements.

In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. Here are some examples of how cash and working capital can be impacted. C NWC will change by the same.

Below are the steps an analyst would take to forecast NWC using a schedule in Excel. Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000. Setting up a Net Working Capital Schedule.

B NWC changes by a greater percentage than the change in sales but the change is linear in nature. It means the change in current assets minus the change in current liabilities. The working capital to gross revenues measure WCGR is a relative newcomer in financial analysis.

Calculate working capital as a percentage of sales using gross sales revenue figures from the profit-and-loss or income statement. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. Secondly the coming years sales forecast is.

Net working capital is defined as current assets minus current liabilities. A Take WC as a of sales each year then use the delta of those two numbers for your FCF impact. B Take change in NWC from 16 to 17 as of sales.

Compare the ratio against other companies in the same industry for additional insights. Change in Net Working Capital 5000 Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities. 05 05 increase in employee cost.

Which one of these best describes the relationship between net working capital NWC and sales. The formula is working capital divided by gross sales times. 19 _____ A NWC changes in direct relation to sales but the change may be less than proportional with sales.

Finance questions and answers. The higher a companys working capital as compared to sales the better off and more stable the company is financially. Which one of these questions can be answered by monitoring a firms balance sheets.

At the very top of the working capital schedule reference sales and cost of goods sold from the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss. Back to farm. In driving Change in NWC impact going forward do you.

Working Capital Turnover Ratio Meaning Formula Calculation

Percentage Increase And Decrease Calculation And Examples Video Lesson Transcript Study Com

The Percentage Of Sales Method Formula Example Video Lesson Transcript Study Com

World Of Cryptocurrencies List Of Nations Cryptocurrency Bitcoin Bitcoin Transaction

Profit Percentage Formula Examples With Excel Template

Mlm Training Secrets From An 8 Figure Earner To Grow A Highly Profitable Mlm Business Mlm Marketing Mlm Training Mlm Business

How Does Tiffany Make Money A Quick Glance At Tiffany Business Model Fourweekmba Strategic Marketing Media Relations Brand Awareness

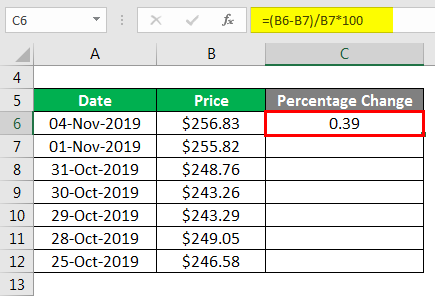

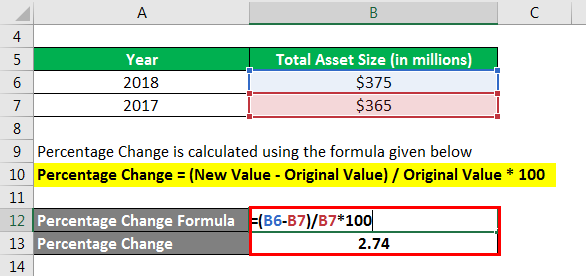

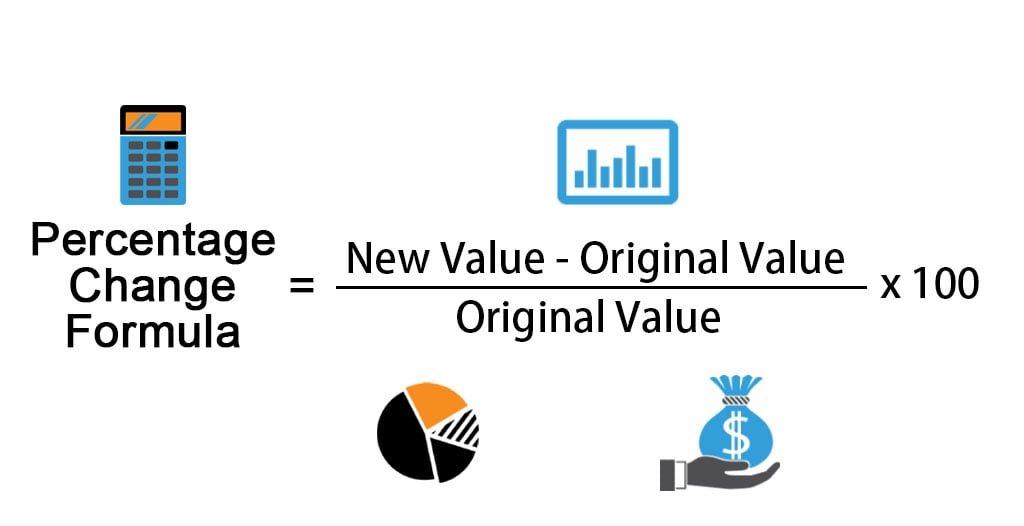

Percentage Change Formula Calculator Example With Excel Template

10 Sample Balance Sheet For Small Business Payment Format Inside Mechanic Job Free Business Card Templates Business Plan Template Business Proposal Template

Profit Percentage Formula Examples With Excel Template

Puttable Bonds Finance Investing Accounting And Finance Investing

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba Business Strategy Business Netflix Business Model

Percentage Change Formula Calculator Example With Excel Template

Changes In Net Working Capital All You Need To Know

Profit Percentage Formula Examples With Excel Template

Return On Net Worth Ronw Scheduled Via Http Www Tailwindapp Com Utm Source Pinterest Utm M Financial Analysis Finance Investing Bookkeeping And Accounting

Percentage Change Formula Calculator Example With Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Interim Financial Statement Template Unique Interim Financial Statements Example Lux Statement Template Mission Statement Template Personal Financial Statement